By Bennet Harvey

The failure of the newspaper industry to innovate an economically competitive Citizen experience and business model has led to the industry’s consolidation into the hands of an ever-smaller number of private equity investors and public companies.

This, in turn has led to a dramatic collapse in the number of daily and weekly newspapers in the country,

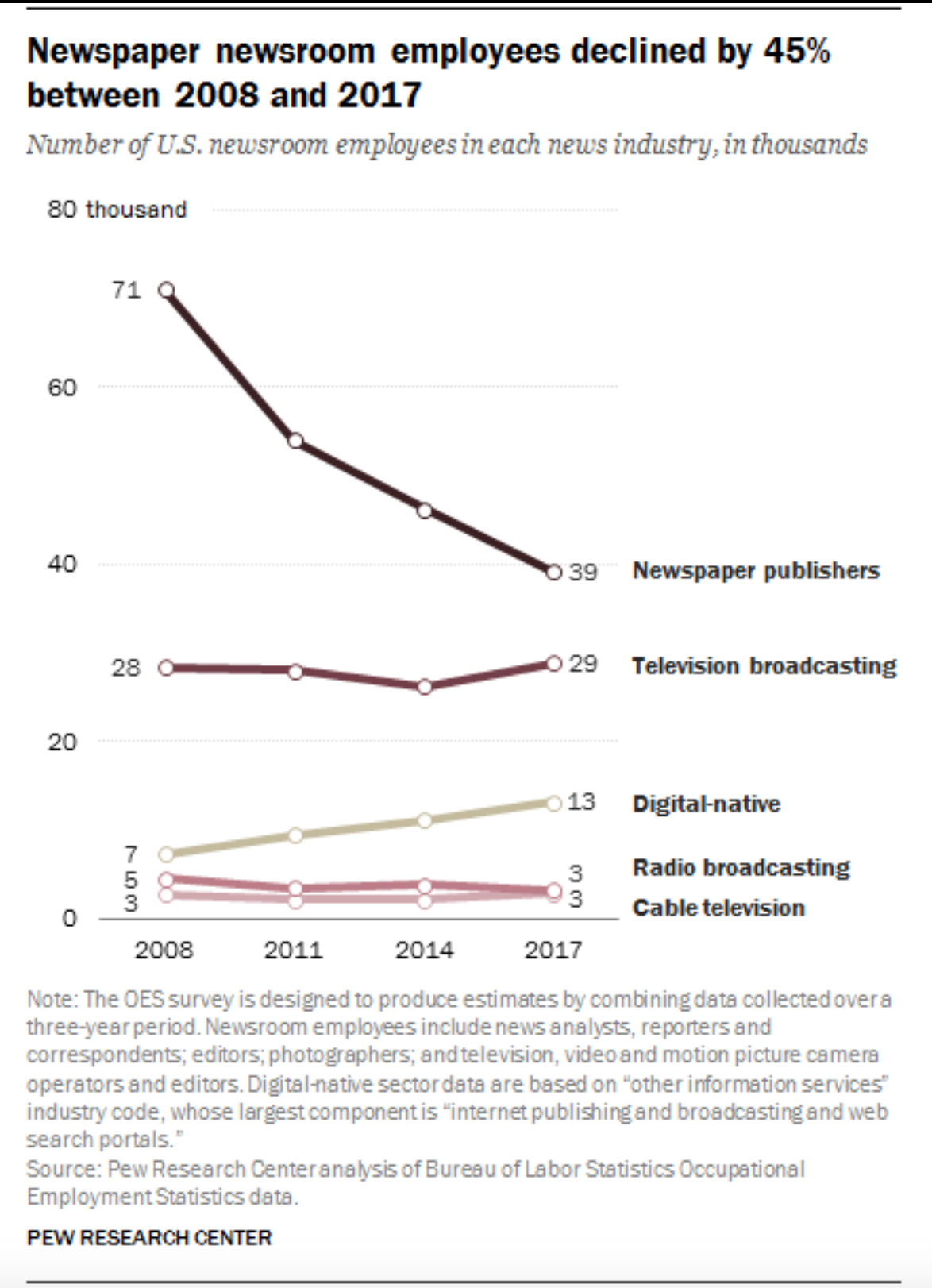

and the loss of half of our newspaper reporters.

This report on the 2022 State of Local News from Penelope Muse Abernathy, teacher at the Northwestern University Medill School of Journalism and former Knight Chair in Journalism and Digital Media Economics at the University of North Carolina, reveals this trend is tightly linked to the emergence of ‘news deserts’, local markets across the US in which Citizens receive little or no local news coverage. In these communities there is virtually no transparency into local, country and school district functions.

Citizens in these communities must fulfill their local civic responsibilities supported only with regional news coverage from cities hundreds of miles away. With no coverage of local city council, planning commission or school board meetings, not to mention crime and community news, these Citizens must blindly vote and pay taxes. Or they must devote individual effort, one-by-one, to actively reach out to these government jurisdictions and digest meetings of minutes themselves. We now pay people to drive our meals to our homes. Can we not find a way to support the journalism that allows us to fulfill our civic duties responsibly?

The gist of this is that the state of news media has now reached a crisis point for American democracy, not only in news deserts, but in institutional trust across the country. Additional articles outside the ReNews login reveal the declining “trust effect” of the existing news media that is dominated by commercial forces.

Owners of the remaining newspaper chains fall into two camps:

- Investors and families with good societal intent who continue to invest in or at least maintain the integrity of their editorial product at some cost to their investment returns.

- Private equity firms who harvest the asset value of news businesses to provide dividends for their investors, ignoring societal consequences as erroneous considerations in pursuit of a single-minded goal to provide short term gains to their small pool of investors. Nearly every year another major US newspaper chain is absorbed by private equity buyers.

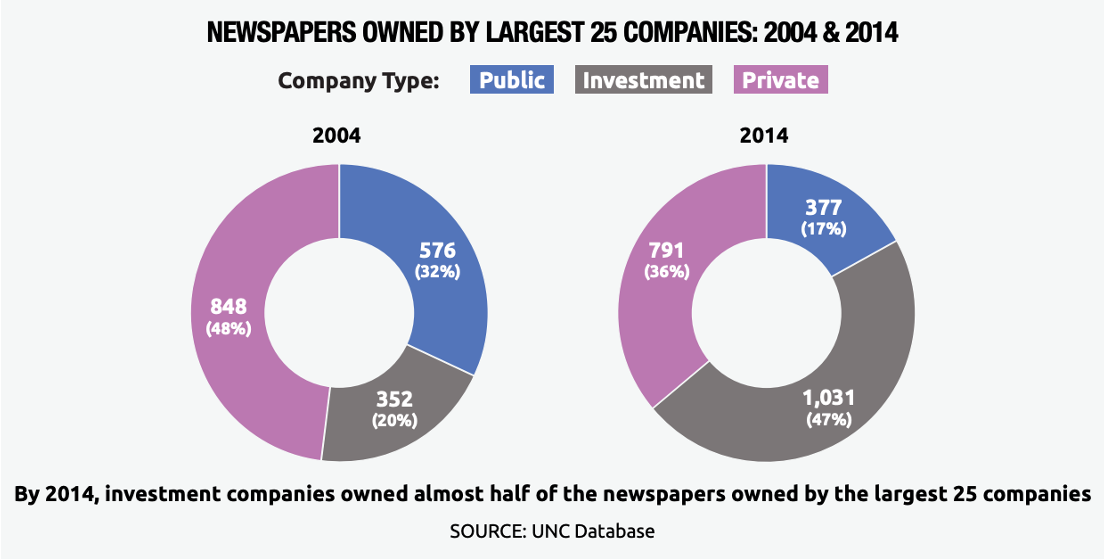

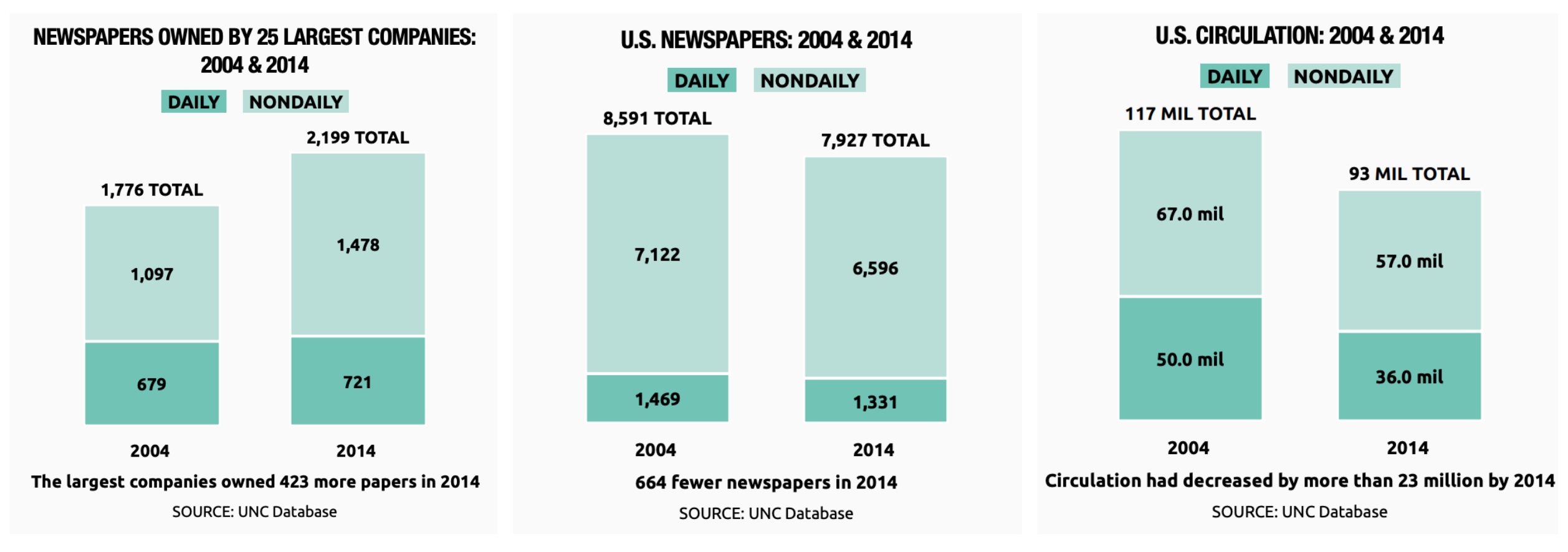

Note in the graph below, that Private Equity ownership of dailies among the top-25 companies increased from 22.5% of total in 2004 to 50.2% in 2014. The trend has only accelerated since 2014 according to details in Abernathy’s report.

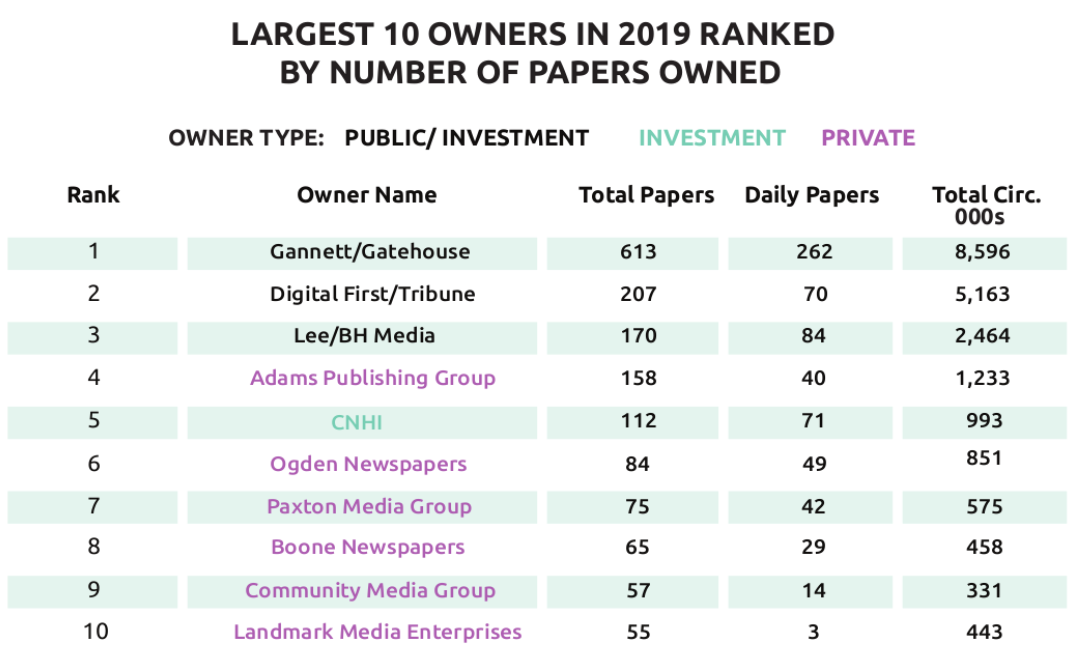

The following is a list from USNewsDeserts.com of the top 10 investment companies in the US by type and numbers of daily and non-daily publications. Note that, after Digital First (controlled by Alden Global Capital) acquired tronc/Tribune it moved to the second position among newspaper holding companies. Digital First / Tribune is a complex set of organizational structures controlled by Alden Global Capital, which is a private equity firm. The still leading newspaper company in the US, Gannett Co, Inc. (NYSE:GCI) is a publicly traded company. Many in the newspaper industry consider Gannett to remain focused on its role as a civic utility, and applauded their victory in beating out Alden’s Digital First to buy Gatehouse a few years ago.

Of course, the industry is anxiously awaiting the next domino to fall. Which of the remaining companies serving the civic needs of their markets will fall to be harvested by a private equity firm focused essentially on salvage? When will they begin dismantling the remaining rusting hulks of past great civic institutions for the benefit of a few privileged high net worth investors?

None of this has the glamour of the old days of media barons. Randolph Hearst’s San Simeon Castle is a museum now, and private equity firm Alden Global Capital owns Colonel McCormick’s Tribune Tower. It’s no longer a battle of titans, but rather more like a yard sale.

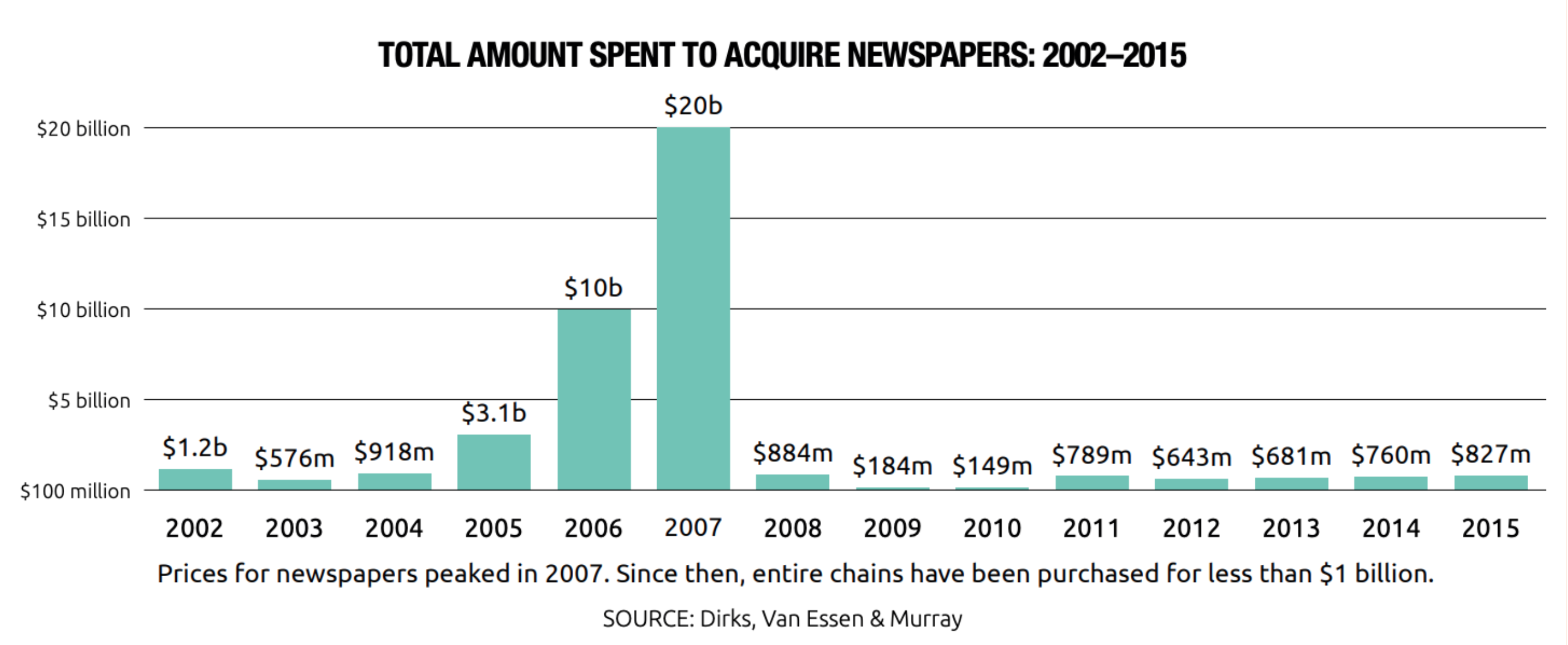

Note below the crash in the value of newspaper company sales immediately following the 2007 emergence of the iPhone and social media. This is not because there were no deals being done. Rather, the valuations of the individual publishers was two or three orders of magnitude cheaper than before the emergence of search and social media.

At ReNews we believe there can only be a couple of rounds of additional news holding company consolidation before the ‘fire sales’ give way to complete industry insolvency. Where will our democracy stand on that day?

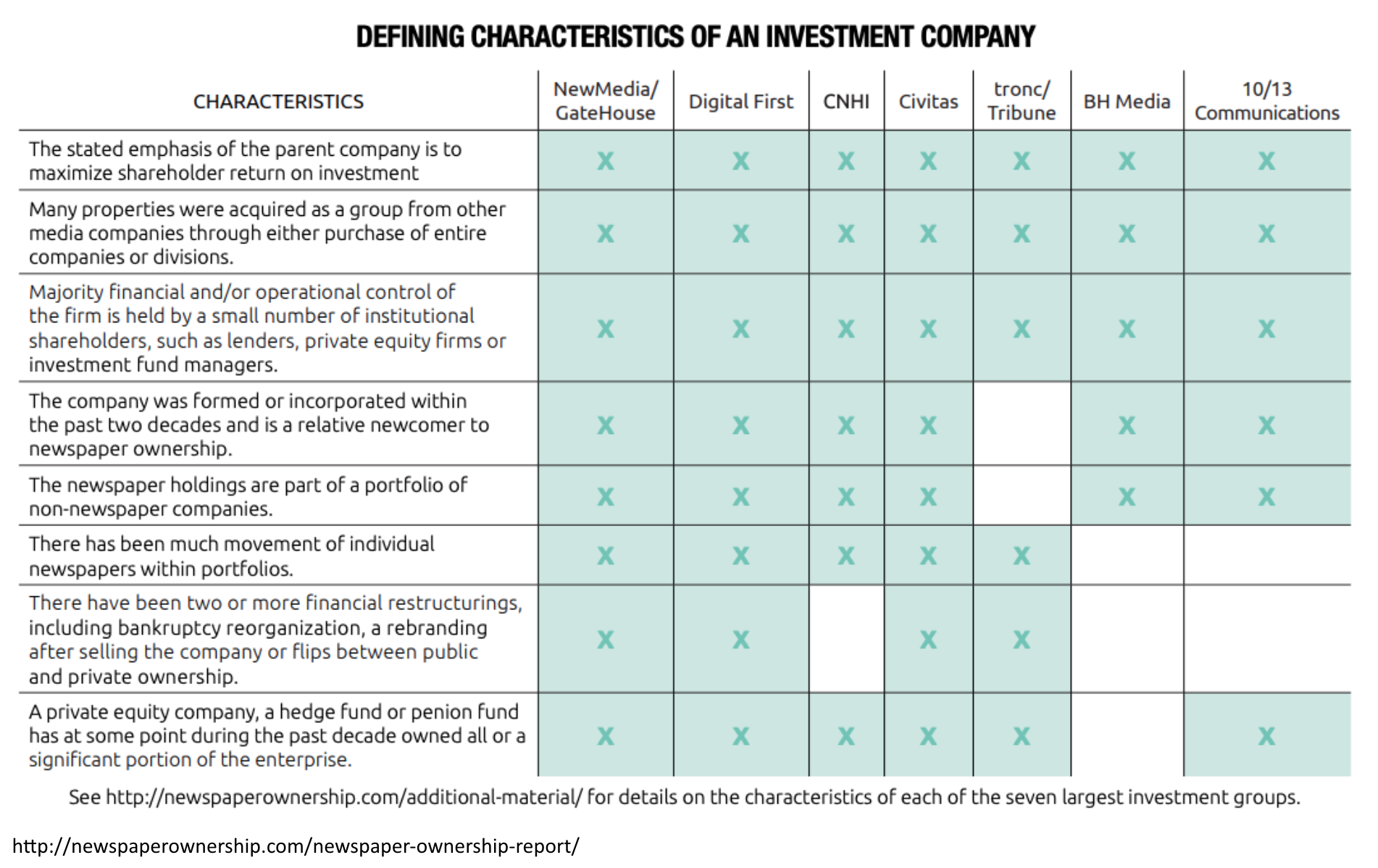

The cruel details of this consolidation of news providers are visible in the decline of the Denver Post at the hands of Alden Global Capital. This private equity firm is one of a handful of investment companies that have emerged to control the majority of daily papers owned by the top-25 companies.

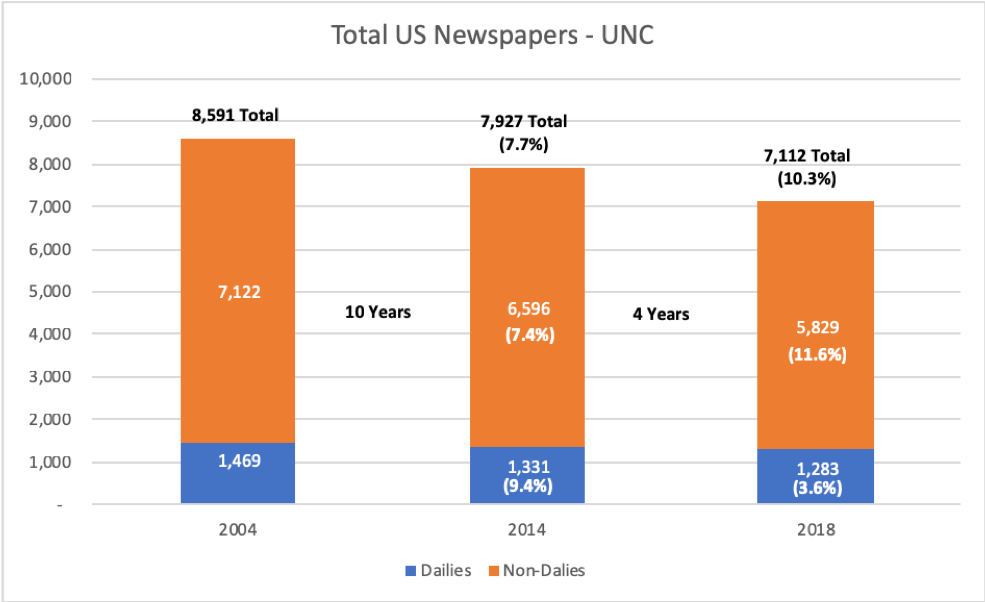

Furthermore, while the number of dailies owned by the top-25 companies increased 6.2% in the 10 years from 2004-2014, the total number of dailies in the U.S. dropped by 7.7% in the same period. The total number of papers dropped still more steeply by another 10.3% in the four years from 2014-2018, largely due to closing of papers by the private equity firms.

The focus of Abernathy’s concern is the expanding news desert landscape across America. The interactive graphic below shows the current status of local news availability by county across the US.

Among the implications of these disturbing trends covered in the 2022 State of Local News Report are:

- further consolidation of newspaper ownership in the hands of a small number of holding companies,

- continued shuttering of papers across America (news deserts), and

- deep cuts in newsroom reporters and editors at the papers that remain (news drought).

Another site, NewspaperOwnership.com, until recently tracked the definition of the investment companies now controlling the majority of our newspapers.

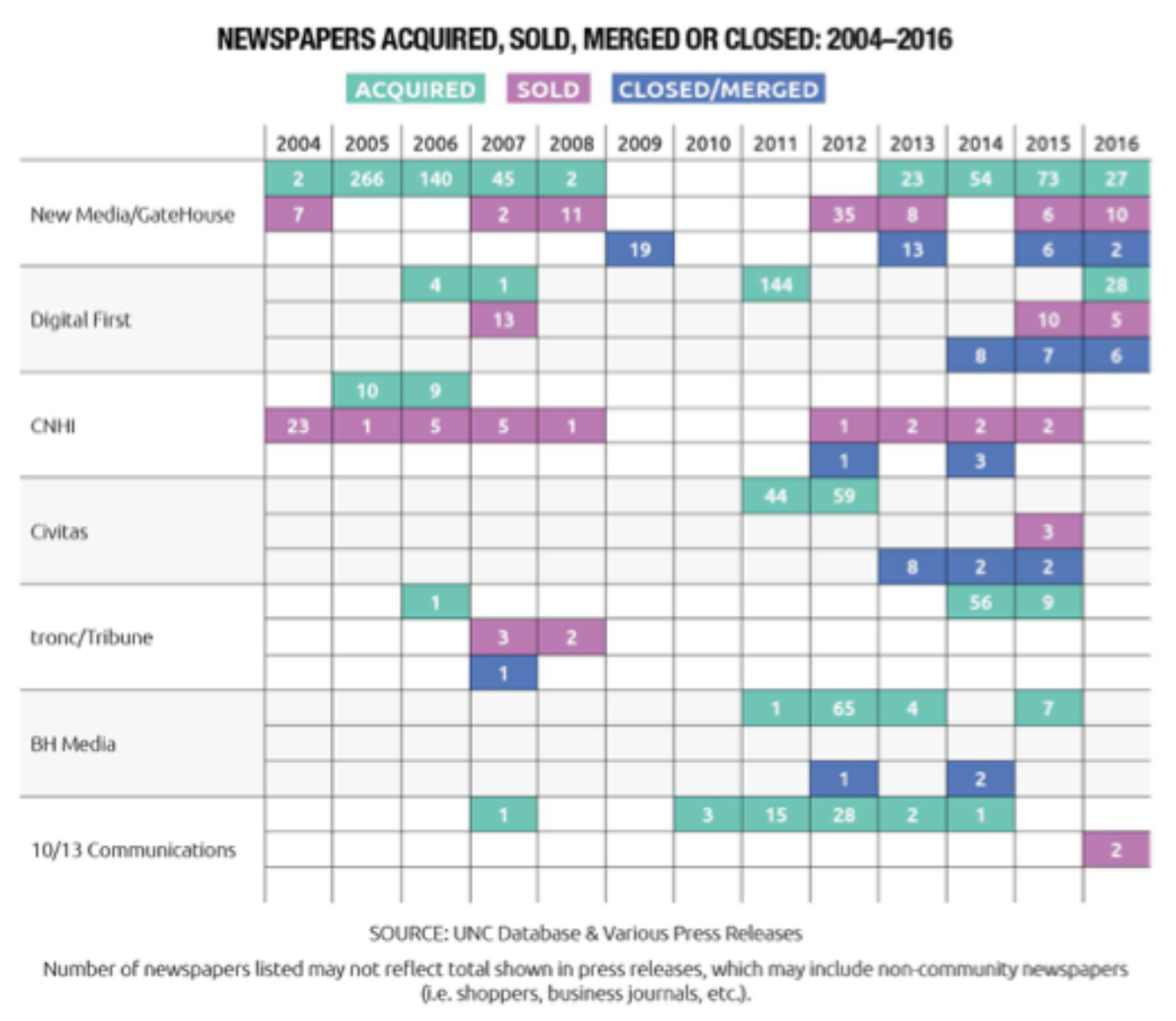

They also tracked the mergers, acquisitions, and shuttering of newspapers by these firms. What is truly frightening to a student of news media is that this data comes from before Digital First Media (Alden Global Capital) acquired tronc/Tribune. We can see that Digital First was the leader in closing / merging publications they acquire. ReNews proposes to commission a project to update and maintain this dataset in to the future to monitor the details behind this driver of civic erosion.

ReNews is designed to capitalize on this moment of crisis and opportunity by injecting a new option – real change. Change is most possible when the entrenched status quo fails.

At ReNews we believe that the ‘buy and harvest’ strategy conducted by Alden and other private equity firms is exploiting the inability of the newspaper industry to find a new and viable economic model. If news outlets existed in a separate and defensible economic model from social media and search, they would be in a better position to restore their function in our democracy.

ReNews proposes to help privately independent and publicly-held publishers avoid this fate by offering our portfolio of news ecosystem innovations, our local news publishing platform, and consulting services, to help publishers with decimated staffs to adopt this sustainable Citizen experience and economic model for news.

Copyright ReNews Media, Inc. 2023